Out on the road, closing sales, grabbing new markets — the life of a company’s top personnel can be a thrilling journey of boardrooms, handshakes, and crushed objectives. Then there are the expense reports. Unwrapping crumpled receipts is no one’s idea of a good time, least of all time-pressed front-office personnel, for whom every minute spent interpreting smeared chits from coffee shops is a minute wasted to new business chances. Multiply the procedure by hundreds or thousands of people. This, in a nutshell, is the acute headache that financial controllers and their staff encounter every month.

In offices around the world, stressed-out finance teams often work late into the night ploughing through interminable reports, knowing that a single mistake can clam up the entire process and play havoc with schedules and budgets.

Many organisations have replaced handwritten expense reports and internal databases with expense-report apps, making it a little easier for employees to input the data from their paper receipts. But for beleaguered finance teams, this hasn’t really changed the deluge of month-end expense reports or the amount of cross-checking and reviewing.

Real time expensing apps are different, reducing the time spent processing and analysing expenses, and providing real-time insights to help manage payments and accounts more efficiently. For time-strapped financial controllers, real-time expensing report apps could be transformative.

Breaking the bottleneck

So just how many billable hours per year might companies be losing to processing expenses? After all, an expense report needs to be filled out by the employee, checked by their manager, and processed by the finance department. According to a study released by the Global Business Travel Association (GBTA), every report takes approximately 20 minutes to process, with an added 18 minutes if potential mistakes trigger a review. And around one in five expense reports needs to be reviewed every month.

To take one real-world example, Innogy Consulting, a Germany-based management consultancy business, was spending 27 hours per month on expense reports before the company switched to Rydoo’s real-time expensing app.

Deloitte Belgium has been an active user of Rydoo since 2015. Finance director Cindy Peeters was candid about the difficulties of processing expense reports at month-end with a workforce of 3,000+. Regardless of the spike in workload, the Deloitte finance team would have to process the data as fast as possible, so the expense could be verified and returned to the employee, as well as included in any client invoices and the company’s statements.

This problem disappears if the finance department can receive a scanned receipt with the requisite cost-centre information in real-time. The employee may even be scanning the bill as they leave the restaurant. When expenses are dealt with in real-time, they can be submitted as they happen and swiftly allocated to the correct employee, client and project.

If you’re a financial controller, this frees up much-needed time at the end of the month. Another major benefit of real-time expensing apps, when compared with spending 27 hours per month on expense reports, is that you control your workload and fit expenses around more important work. Such on-demand expense apps suit the on-the-go employee, but that doesn’t mean the financial controllers need to be on-demand too.

Keeping up means keeping track

Until they are reviewed at the end of a month, everyone is in the dark about what expense reports actually contain – what is owed to employees, what needs to be included on client invoices and which expenses the company needs to cover. It can take two months after the purchase to settle a claim, during which time disgruntled employees might start asking why they haven’t been reimbursed, and clients might demand to know why their invoices are both late and inaccurate. There’s also likely to be a great deal of cross-checking and hold-ups before a company knows it has been defrauded through its expense system.

When you can see expenses in real-time, you can keep track of client accounts and projects, building separate reports and pinpointing when projects may be about to go over budget. With the addition of a country button at the user’s end, Rydoo also calculates the correct VAT rate based on the country, category of expense and the nature of the employee’s company. This provides a more accurate picture of the expense incurred and makes reclaiming VAT a lot easier.

A productive workforce

There’s more than a grain of truth in the old adage that happy workers are productive workers. Employees filling out complicated expense reports are rarely happy workers – they often have to save receipts, fill in the details from every transaction into an internal database or expense-report app and endure a long wait for approval and reimbursement.

One line to fill in and a receipt image captured on an app – all saved on the phone in their pocket – gives employees that all-important sense of control. And if they are generating real time expenses as they go along, not only can they be reimbursed quicker, but approval won’t be held up by one or two rejected or contended claims. This makes for happier and – crucially – more productive workers.

Cindy Peeters at Deloitte Belgium noted that, with month-end expense reports gone and intuitive real-time expensing reports taking their place, employees are more interested in the company’s expense policy. They are now pushed to consider whether their expenses can actually be reclaimed – they want to know the rules. And, for the finance team, this means fewer expense claims containing errors and fewer claims that can’t be reimbursed.

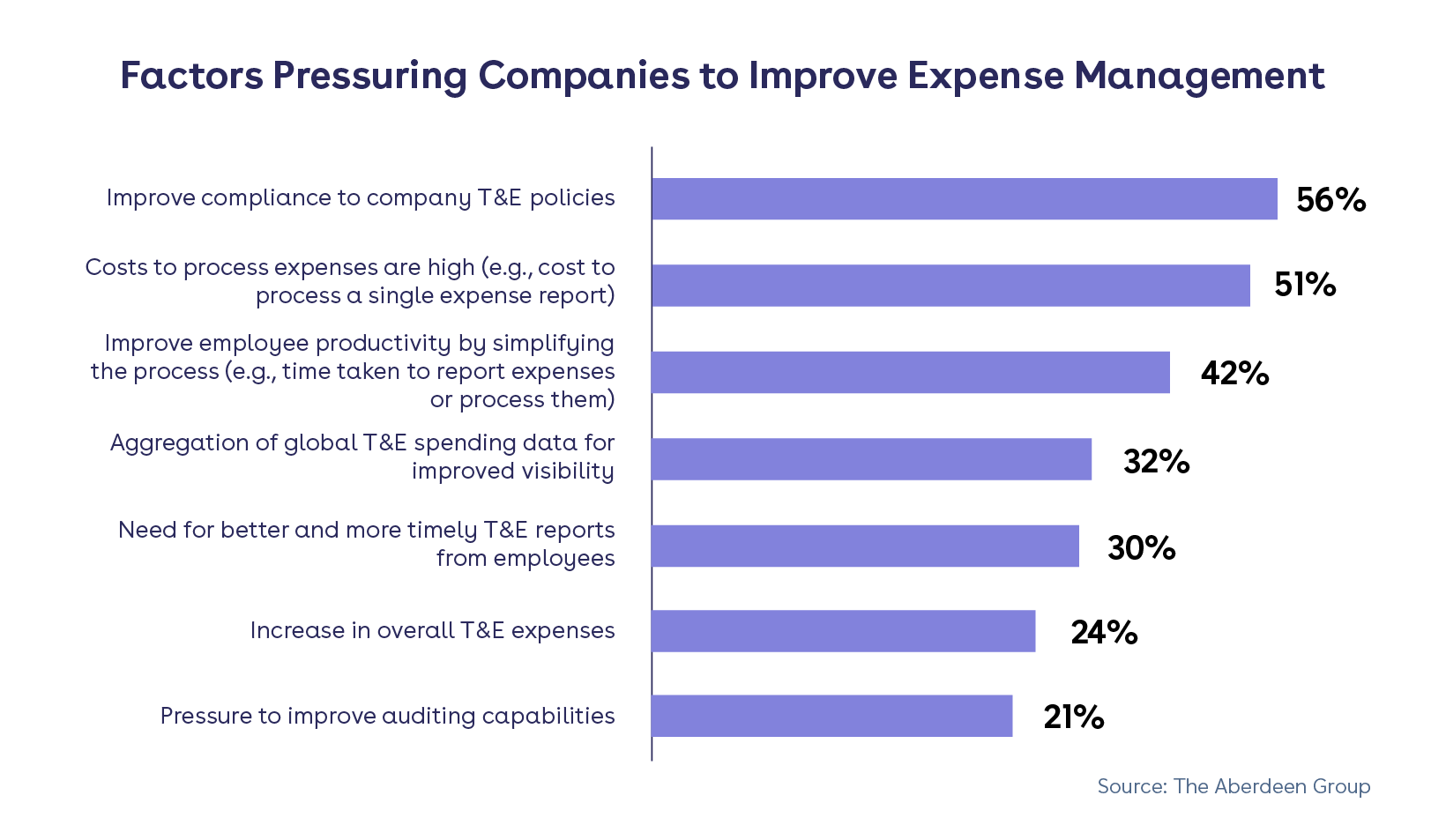

Research of companies globally by The Aberdeen Group supports Cindy’s argument – businesses primarily look to update their expense management process to improve visibility into employee spending and compliance, closely followed by the control and reduction of costs, and eliminating manual processes.

The path to paperless expenses

In the past, all receipts had to be kept. But today, many jurisdictions accept a digital copy. In fact, Innogy Consulting so valued Rydoo’s paperless element that they worked with their auditor to define and document their processes in compliance with Germany’s bookkeeping regulations and the local tax authority. As soon as the employee has sent their digital copy, receipts can be taken right out of the equation.

But how does it work? How can expense claims be made and logged without keeping receipts? Optical character recognition (OCR) can recognize numbers and letters, converting different types of documents to PDFs or images. The recognition algorithm will capture every character, as the employee doesn’t have to enter them manually, significantly cutting down on the cross-checking and mistakes that tend to hold up the processing of claims and reimbursements. And more importantly, the receipt’s date, price, and vendor are all searchable. As financial controllers, you can do a quick search and in seconds create larger expense reports based on individual employees, clients, and projects.

Take back your time and recover your resources

At Rydoo, we aim to provide a user-friendly real-time expense app that allows financial controllers to choose when they sign off expenses while providing a greater level of control and oversight.

Expenses that can be submitted and approved in real-time give financial controllers a better idea of just what it is their business and clients are spending money on. And finance teams can then create and update reports from approved expenses to keep on top of important projects and clients. By offering real-time control of the expenses process, Rydoo aims to make those hated expense reports – and the late nights in the office they entailed – a thing of the past.