Whether you’re simplifying your expense process, battling fraud, or hoping to forecast costs better, a successful travel & expense policy is vital. That’s why we decided to create a whitepaper, in which we’ll explore in detail why robust policy matters, how to write a policy that communicates what you need it to communicate and whether technology can help to implement and oversee your policy. But let’s begin with the basics: do you know what is a Travel and Expense Policy and why does it matter?

In this blog post, we’ll discuss what issues a travel & expense (T&E) policy is trying to solve and we’ll look at costs, fraud, mistakes, and daily expenses, and how they can quickly spiral out of control without a well-written expense policy that employees can easily follow. Remember, the job of a good T&E policy is to remove ambiguity – something is either allowed or it is not, and with that, avoid fraud.

What is a travel & expense policy?

It’s a list of do’s and don’ts, a way to battle fraud, and a tool for keeping your costs down. But a travel & expense (T&E) policy is much more than that. It’s about your company’s culture and values – this is a guide to how your employees should conduct themselves when they are representing your business.

We think a policy that is clear, comprehensive, and works in the real world can win the support of the travelling employee. And that employee is likely to understand and engage more with a policy that is entered into an expense management system they can use in real-time. This allows the finance team to better enforce the policy and the employee to immediately challenge or delete any disputed expenses.

Remember, your employees are your representatives out there in the world – give them the information and the tools they need to be the face of your company wherever they go.

Why Travel & Expense Policies Matter

You may not be able to entirely eliminate everything outlined below, but a well-put-together T&E policy that defines the types of expenses allowed and the amount that can be spent can limit abuse and mistakes. The job of a good T&E policy is to remove ambiguity – something is either allowed or it is not.

We’ll discuss the best way to put together an expense policy in the next section, but first, let’s look at why this might be one of the most valuable documents your company will ever create.

Keep on top of a big cost

Travel and expenses are most companies’ second-biggest cost and that’s only set to increase. Companies across all sectors are becoming more globalized, which is resulting in greater volumes of travel transactions.

You need an effective means of keeping up with these changes and staying on top of the expenditure involved. One of the benefits of a travel & expense policy is that it states the maximum spend for every possible item, which can also help the finance team forecast costs. Of course, for those costs to remain low and those forecasts to be accurate, the policy needs to be both clear and well implemented.

Everyone makes mistakes

Mistakes and fraud can seem interchangeable, but mistakes don’t have to lead to a monetary gain for the employee. And, as we’ve discussed, multiple reimbursements and overstated expenses can be due to human error.

Sometimes, an employee will break a policy rule, but not maliciously. They may spend more on a flight than the policy allows. Sounds bad, but what if it had been a choice between a direct flight and two stops with a seven-hour layover? They may have missed the very reason they were travelling if they had followed the policy and taken the long flight. In such instances, you can discuss the options with the traveller and reach a satisfactory conclusion. But – as we will find out below – it’s best to have these issues flagged and dealt with separately, rather than fill the expense policy with exceptions to the rule. Once you introduce exceptions, it’s a slippery slope.

Managing daily expenses

Not all companies keep every expense separate, many use per diems to set a daily allowance. Putting a per diem rate into your T&E policy can give your employees a clear limit for how much they can spend every day. If you don’t use per diems, an employee could make a number of legitimate expenses – and do so in all innocence – but cost the company more money than expected. A set daily rate can take care of such an eventuality.

Per diems are also considered reimbursement for business expenses and are therefore tax-free up to the maximum allowable per-diem rate. This rate changes from one country to the next and each country will have different rates for domestic travel and individual overseas territories. Therefore, if you have branches in a number of countries, ensure the right up-to-date per diem rate is included in the T&E policy for the relevant employees.

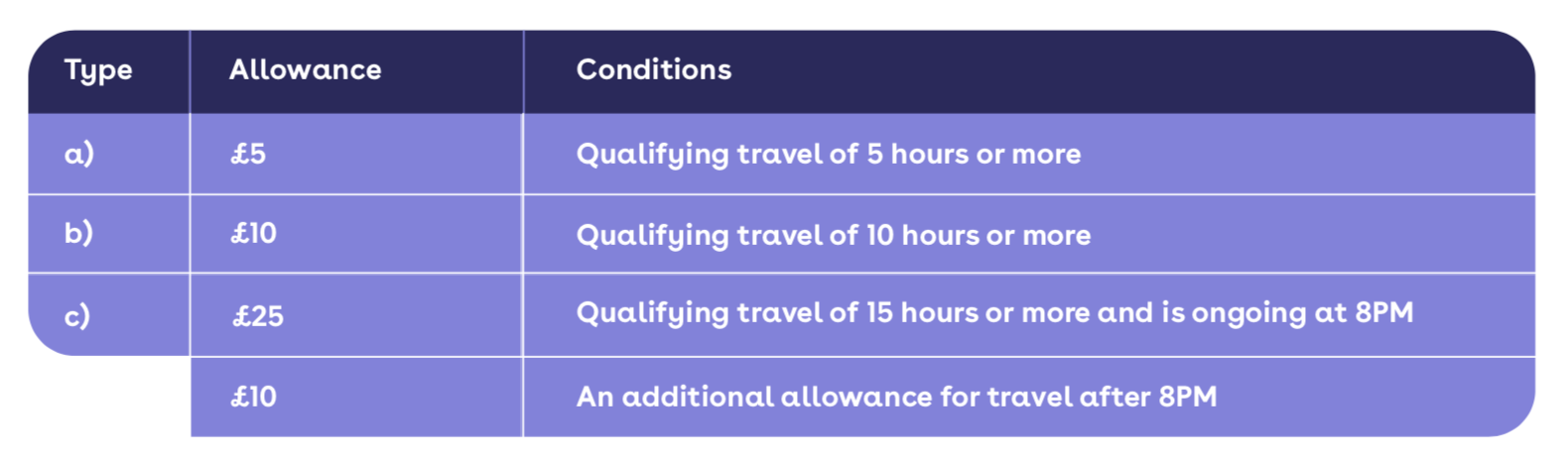

Let’s look at an example of a region’s per diem allowance. The UK maintains the following domestic per diem rates:

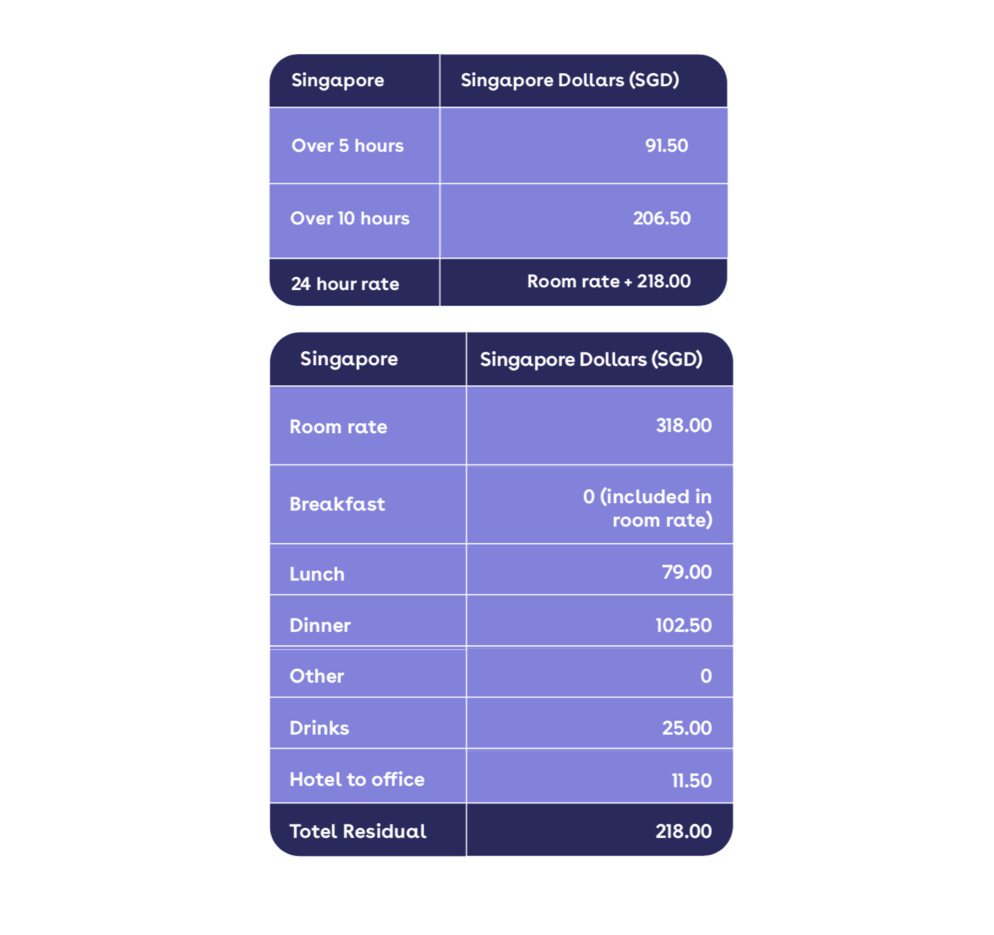

HMRC’s rules for overseas business trips are more specific and based on the country and city being visited. UK business travellers in Singapore, for example, are subject to the following rates:

If you’re using a country’s default per diem rates, and expenses app, such as Rydoo’s, can help you keep your policy up to date with any changes in individual countries where you may be based. Your employees will then be able to deduct expenses from their per diem until they have reached their limit. If you wish, your employees will be able to spend more according to your T&E policy, but the standard per diem rate is the most you can claim tax back on.

Rydoo it

We hope we have given you enriching insights to give a killer answer next time someone asks `What is a Travel and Expense Policy and why does it matter? `. Looking for a personalised approach to understanding how a T&E Policy can benefit your company? Book a demo with one of our specialists.